ABCs of Accounting and Finance

The differences between an Accountant, Bookkeeper, Controller, CFO and CPA, and when to enlist each for your business.

Our economy continues to grow despite many obstacles over the past few years. Chances are that you, and your business, are operating differently today than you were at the start of the decade. You may operate in the same industry, you may have the same business card, but industry shifts, competitive changes, and the rapid adoption of technologies to enable virtual work, have caused everything about your business to change. And in a relatively short amount of time.

As part of a series of articles focused on helping small businesses to achieve next-level growth, this article highlights two areas that most growing businesses often overlook: their financial data, and enlisting the right expertise, at the right time in the business lifecycle, to gain insights and execute a winning financial strategy for growth.

This article is intended to help businesses owners:

- Understand the differences between various accounting roles

- Identify the stage in the lifecycle of your business in which you need each role

- Realize that to grow your business, you will need more than a bookkeeper

- Prepare for growth by building a strong financial foundation

- Access a Controller or CFO to build a strong financial foundation

In the life of a business, the entrepreneurs often start off by maintaining the books themselves. They will likely hire a bookkeeper to record daily accounting transactions and a CPA to prepare the company’s tax returns. From there they will seek the necessary expertise they believe they need when they need it.

Did you know that there are distinct differences between an Accountant, a Bookkeeper, a Controller, a CFO (Chief Financial Officer), and a CPA (Certified Public Accountant)? These terms are frequently used interchangeably, but there are some noteworthy differences among them. Knowing the differences will help you to understand when and how to enlist each in order to organize your financial data, gain a 360-degree perspective of your business’ finances, partner with the right experts to protect the business from fraud, keep you compliant and out of trouble, and leverage financial intelligence and strategies to win by driving profitable growth.

Let’s review the key responsibilities of accounting and finance roles, and the appropriate disciplines to put to work at various points in the lifecycle of your business.

Bookkeeper

When a business is launched and getting off the ground, a bookkeeper is strongly recommended to record daily transactions such as accounts payable (A/P) invoices, customer billings, and receipts or collections from customers in an accounting system like QuickBooks. They may also assist with sales and procurement activities including preparing sales orders and purchase orders. Bookkeepers are known for their organization skills and attention to detail.

In general, bookkeepers do not have a degree in accounting and have not completed college level courses in accounting or finance. In larger companies, they may have the title Accounting Clerk or Accounting Specialist.

Financial information produced from the accounting system by bookkeepers is usually on a cash basis.

When to Hire a Bookkeeper: When a company is starting up and the accounting transaction volume is more than the entrepreneur can maintain on his/her own.

Accountant

Accountants usually have a bachelor’s degree in accounting or finance. They understand debits and credits and where accounting transactions should be recorded in the general ledger in accordance with GAAP (Generally Accepted Accounting Principles). Accountants have experience preparing journal entries, closing the books (accounting records), preparing balance sheet account reconciliations, and producing monthly financial statements (balance sheet, income statement, and cash flow statement) on an accrual basis.

When to Hire an Accountant: If the company has an investor or a bank loan that requires financial statements be prepared and delivered annually or more frequently, an accountant will be needed to prepare accrual based financial statements.

Controller

Controllers control accounting activities on a daily basis. When there is more than one person in accounting, it is important that the next person hired is a Controller. Controllers supervise and manage accounting staff and review their work. In smaller companies, Controllers can also perform the work of bookkeepers and accountants. Controllers typically have a degree in accounting or finance and 5-10 years of accounting and supervisory experience. Controllers are expected to have advanced skills in GAAP (discussed in Accountant section above). Controllers can train accounting staff and often will cross-train them so that more than one person can perform a function.

Controllers prepare the annual budget. On a monthly basis they prepare a variance analysis of the financial statements and compare actual results to budget. Controllers review financial statements and know how to spot errors in them. Controllers prepare cash flow statements as part of the monthly financial reporting package. If cash is tight, they may also prepare cash flow projections, typically looking ahead 3 months to determine what the company’s cash requirements will be. Controllers work closely with the bank on the company’s cash management.

Controllers ensure a strong internal controls environment exists at a company. Strong internal controls will ensure that controls such as segregation of duties, authorized signers, approval processes, review functions and others are in place. One example of an internal control is segregation of duties which is specifically focused on cash receipts and cash disbursements in order to minimize the risk of fraud and embezzlement.

Controllers are responsible for compliance with debt covenants, external reporting requirements, and federal, state and local taxing authority requirements (i.e. sales and use tax reporting, property taxes, etc.).

A good analogy for a Controller is a train engineer who keeps the trains running on time and on the right track.

When to Hire a Controller: When the Bookkeeper can’t keep up with the volume of accounting transactions and it’s time to hire a second person in accounting, make sure the next hire is a Controller.

CFO (Chief Financial Officer)

A Chief Financial Officer (CFO) partners with the CEO or business owner and provides guidance and support on growth initiatives, financing strategies, and cost effectiveness in operations. CFOs work on financing or arranging alternative sources of funds, determine working capital requirements, negotiate contracts with customers and vendors as needed, and manage investor relations. In smaller organizations, CFOs typically manage HR and IT.

For organizations looking to grow through acquisition, a CFO is essential to evaluate the acquisition targets and perform due diligence. Conversely, if the company is looking to be sold, a CFO can be critical to ensuring a strong financial foundation is in place prior to the sale. The acquiring company will want to perform due diligence and a CFO can ensure this process runs smoothly and all questions are answered and requests for data are met.

When to Hire a CFO: A CFO is an important business partner who can be instrumental in ensuring the financial health of the organization, managing risk, and strategizing on the best ways to achieve growth objectives. There are several triggers indicating a business needs a CFO:

- High growth companies

- Companies considering an exit or sale

- External investors such as publicly held companies, venture capital (VC) backed, or private equity (PE) owned companies

- Financially troubled companies

A full time CFO should be hired as soon as the organization can afford it, but at least by the time the company reaches $50M in sales. The decision to hire a CFO also depends on the complexity of the business. If it has multiple streams of revenue, regulatory reporting requirements, or outside investors, the business may need a CFO much sooner.

For small businesses, CFOs can be hired on a fractional (part-time) basis. A few days a month or one day a week to start. CFOs frequently find costs savings in an organization and quickly add value, thus minimizing their cost to hire.

Certified Public Accountants (CPA)

Certified Public Accountants (CPA) are commonly known as tax strategists and tax preparers. Many small business owners frequently refer to their CPA as their “accountant”. Hence the misconception with the Accountant role described above. Some CPA firms have built-in the capability to provide outsourced accounting services, however most do not provide these services. Larger CPA firms, including the Big 4, provide audit or attest services for their clients in addition to tax services. Due to a conflict of interest, these CPA firms cannot provide accounting services for their audit clients.

There are many accounting and tax professionals who earn their CPA certification while working for a public accounting firm. These professionals then go on to work for companies as a Controller, CFO, Tax Manager or Tax Director depending on their area of expertise in accounting or tax. This can also create a misconception as there are CPAs who do not perform tax work.

When to Hire a CPA: Any business with revenue greater than $1M should have their annual tax return prepared by a CPA. These businesses should look to their CPA as a business advisor and tax strategist. Additionally, a CPA firm may be engaged to provide audit services for regulatory or debt compliance or a request by a significant shareholder or investor.

The reason that many small businesses overlook the opportunity to use their finances to create a competitive advantage, is because they view their financial data as simply scoreboard data. When you take a fresh look at your business’ finances and see them through the lens of a trained financial expert, new opportunities to create a competitive edge for your business will emerge. And today more than ever, as our industry and business continue to change, we must use every opportunity to leverage actionable intelligence in order to achieve sustainable growth.

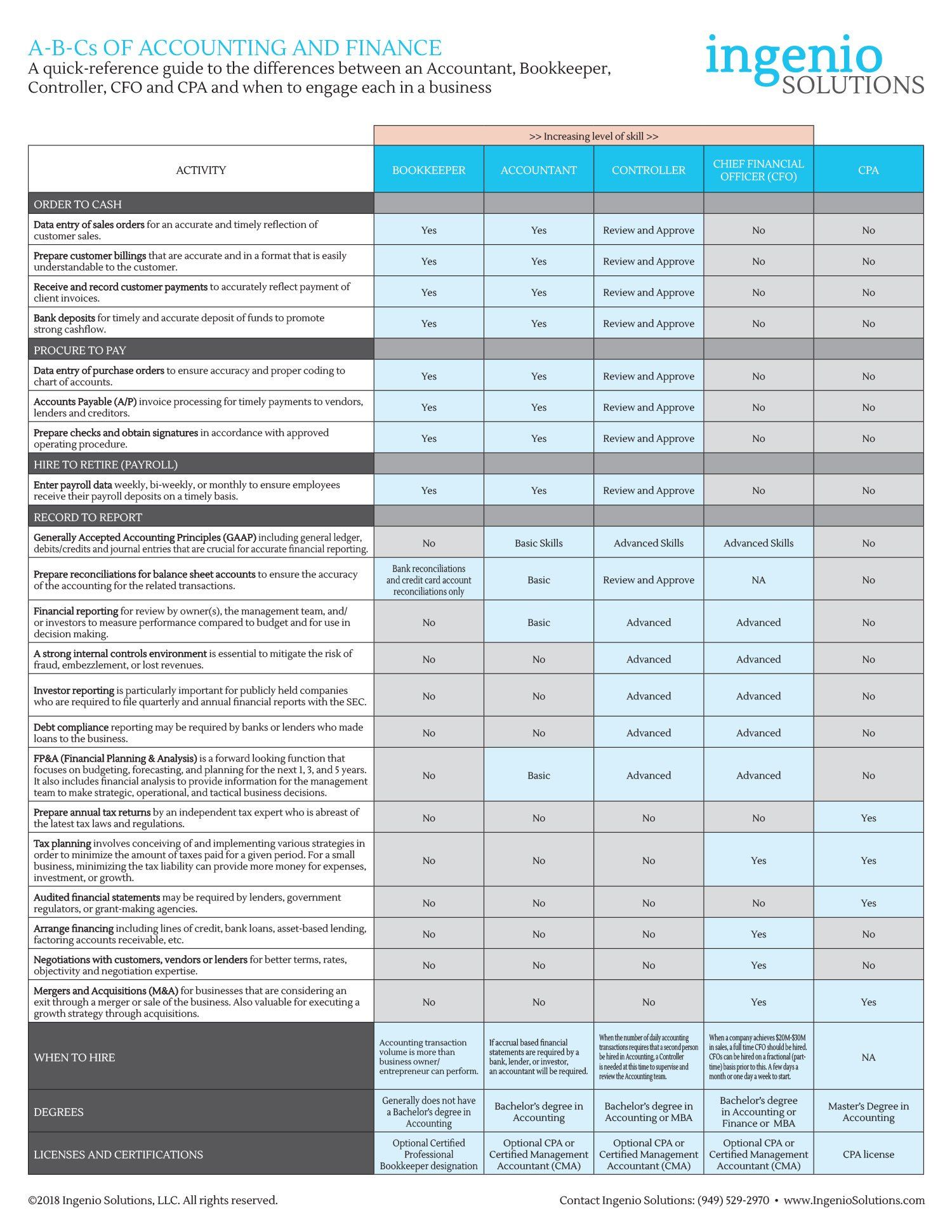

See the chart below as a quick-reference guide to the differences.

Fractional CFOs – the next step to next-level growth

Small businesses that have a bookkeeper and are not yet ready for a full-time CFO may enlist a Fractional CFO – someone who can work closely with the business owner to strategize, handle financing needs, perform financial analysis, prepare budgets, assess and manage risk in the organization, negotiate better pricing with vendors, and resolve thorny financial matters with clients or vendors, on a part-time or fixed-term basis. Ingenio Solutions can provide fractional CFOs to supplement the efforts of bookkeepers and provide financial guidance to the business owner or company executive to grow to the next level. For more information call (949)529-2970 or email info@ingeniosolutions.com. Ingenio Solutions offers a 60 minute complimentary consultation.